2024 Federal Mileage Rate

2024 Federal Mileage Rate. Prices listed are msrp and are based on information updated on this website from time to time. The new rate kicks in beginning jan.

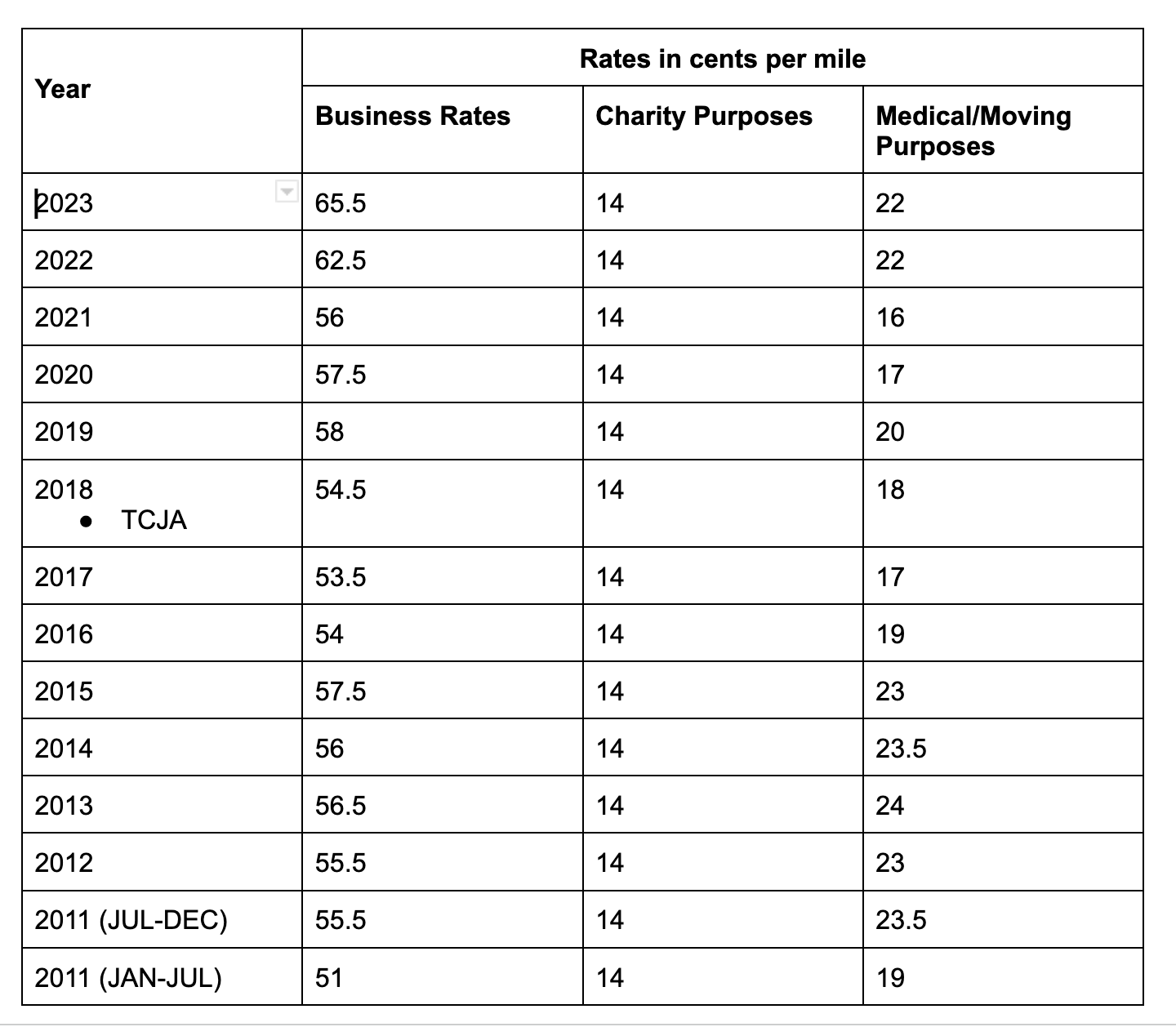

The irs bumped up the optional mileage rate to 67 cents a mile in 2024 for business use, up from 65.5 cents for 2023. 65.5 cents per mile for business use.

Gsa Has Adjusted All Pov Mileage Reimbursement Rates Effective January 1, 2024.

65.5 cents per mile for.

Beginning January 1, 2024, The Standard Mileage Rates For The Use Of A Car (Also Vans, Pickups, Or Panel Trucks) Will Be As Follows:

To take the deduction, taxpayers must meet use.

65.5 Cents Per Mile For Business Use.

Images References :

Source: winnyqaeriela.pages.dev

Source: winnyqaeriela.pages.dev

Pa Mileage Reimbursement 2024 Ingrid Catrina, 14 cents per mile for charitable. Irs issues standard mileage rates for 2024;

Source: smallbiztrends.com

Source: smallbiztrends.com

IRS Announces 2024 Mileage Reimbursement Rate, Use this tool to estimate monthly payments on a lease or finance of your nissan vehicle. Effective january 1, 2024, the business standard mileage rate for use of a car (including vans, pickup trucks and panel trucks) increases from $0.655 to $0.67, and the rate for.

Source: bmf.cpa

Source: bmf.cpa

IRS Releases 2024 Standard Mileage Rates BMF, Effective january 1, 2024, the business standard mileage rate for use of a car (including vans, pickup trucks and panel trucks) increases from $0.655 to $0.67, and the rate for. The mileage reimbursement rate for all travel expenses incurred on or after january 1, 2024, has risen to 67 cents per mile.

Source: www.moneymakermagazine.com

Source: www.moneymakermagazine.com

Mileage Rate 2024 Top 5 Insane Tax Hacks You Need!, 67 cents per mile driven for business use, up 1.5 cents from. The irs has announced the new standard mileage rates for 2024.

Source: jhandco.com

Source: jhandco.com

IRS Unveils 2024 Mileage RatesUp 1.5 Cents J.… J. Hall & Company, Employees requesting reimbursement for the use of a pov on or after january 1, 2024, are to use the applicable rate from the table below for their. The irs bumped up the optional mileage rate to 67 cents a mile in 2024 for business use, up from 65.5 cents for 2023.

Source: ministrycpa.blogspot.com

Source: ministrycpa.blogspot.com

2024 Standard Mileage Rates, The irs has announced the new standard mileage rates for 2024. The irs has announced the new standard mileage rates for 2024.

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg) Source: medriva.com

Source: medriva.com

Understanding the 2024 IRS Standard Mileage Rates, The irs is raising the standard mileage rate by 1.5 cents per mile for 2024. Rates and charges as of 20th may 2024) bank of maharashtra is.

Source: corabelwgustie.pages.dev

Source: corabelwgustie.pages.dev

Irs Rate For Mileage Reimbursement 2024 Peggy Blakelee, Use this tool to estimate monthly payments on a lease or finance of your nissan vehicle. This rate change applies to all claimants,.

Source: www.taxconnections.com

Source: www.taxconnections.com

2024 Standard Mileage Rates Announced By The IRS 2024 Standard, The irs has announced the new standard mileage rates for 2024. 17 rows if you use your car for business, charity, medical or moving purposes, you may.

Source: www.broadridgeadvisor.com

Source: www.broadridgeadvisor.com

IRS Releases Standard Mileage Rates for 2024, Select your vehicle in step 1 and customize your. 14 announced that the business standard mileage rate per mile is.

67 Cents Per Mile For Business.

14 cents per mile for charitable.

For 2024, The Gsa Has Updated Its Mileage Reimbursement Rates, A Critical Figure For Many Businesses And Employees Who.

The irs mileage rates for 2024 vary based on the purpose of travel.